Overview

In 2020, we initiated a project to introduce the concept of a wallet to our merchants, starting with dashboard users for testing and gathering insights. In 2021, we focused on addressing the issue of low merchant wallet balances, which increases the risk of payment failure.

Our primary objective is to ensure successful revenue collection by securing deduction money from merchants. Our secondary goal is to increase wallet usage by adding more use cases through third-party business offerings. To achieve this, PM propose switching from automatic to on-demand payouts, which will require manual withdrawal.

My role

Lead Product Designer

Project Timeline

Nov 2020 – April 2021

MVP 1 – Web Dashboard

Jun – Sep 2021

MVP 2 – Mobile Apps (this case study)

The Problem

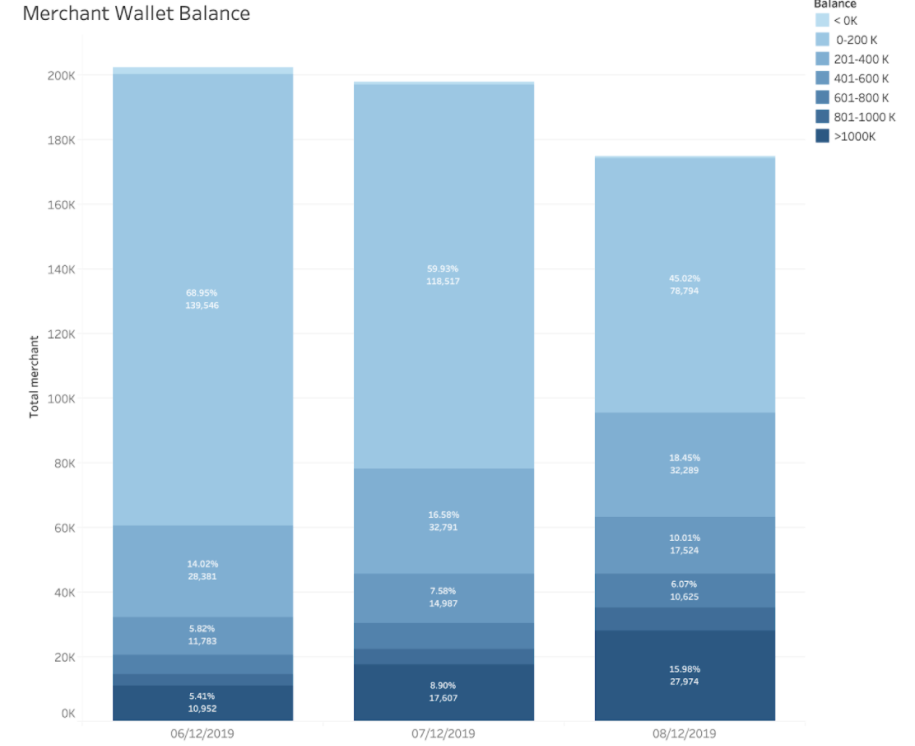

Many merchants have a balance of less than IDR 200,000 in their merchant wallet, which unfortunately is not enough to cover their subscription and installment obligations. Specifically, 68% (139,546 out of 202,382 merchants) have merchant wallet balances below IDR 200,000, increasing the chance of payment failure.

Goals

Increase successful revenue collected by improving effectiveness of Wallet usage for existing merchants

Potential revenue loss 35% of POS merchants fail to be deducted because they do not have enough balance in their merchant wallets on Pre-Covid February 2020.

IDR 4.8B

Potential Deduction

IDR 1.7B (35.04%)

Delayed Deduction (Potential loss)

Increase the use of Wallet by adding more use cases through third party Business Offering

By using our wallet, we offer a seamless way for merchants to purchase goods and services to support their business from our platform, using the money they receive from consumers. To provide a wide range of use cases for our merchants, we need a way for them to maintain a higher average balance on their wallet (e.g., for GoFresh, Tjetak).

IDR 86.000 – 239.000

Average wallet balance

< IDR 200.000

Average wallet balance

Solution

Constrain

— The current deduction system won’t deduct the money if the balance is not enough

— The auto payout will happens daily at 4AM when the merchant has a balance more than IDR 10.000

— Partial amount payout is out of scope in this initiative

— Multi-outlet are out of scope in this initiative

Proposed Solution

The Product Manager and Business Stakeholder came up with the idea of changing the current automatic payout system to an On-Demand payout system, which requires manual withdrawal. However, from a design and research perspective, we are unsure if this idea will be easily accepted by merchants since it will require a change in their behavior.

Pros:

— Will help some merchant to be able to purchase or pay service/goods within Gojek’s products

— Will allow us to lock the balance temporarily when the system can’t deduct their money

Cons:

Changing the behavior of merchants can, in some ways, reduce their liquidity.

Metrics

- Increasing the deduction success rate to 100%

- Reduce the number of complaints of payout visibility

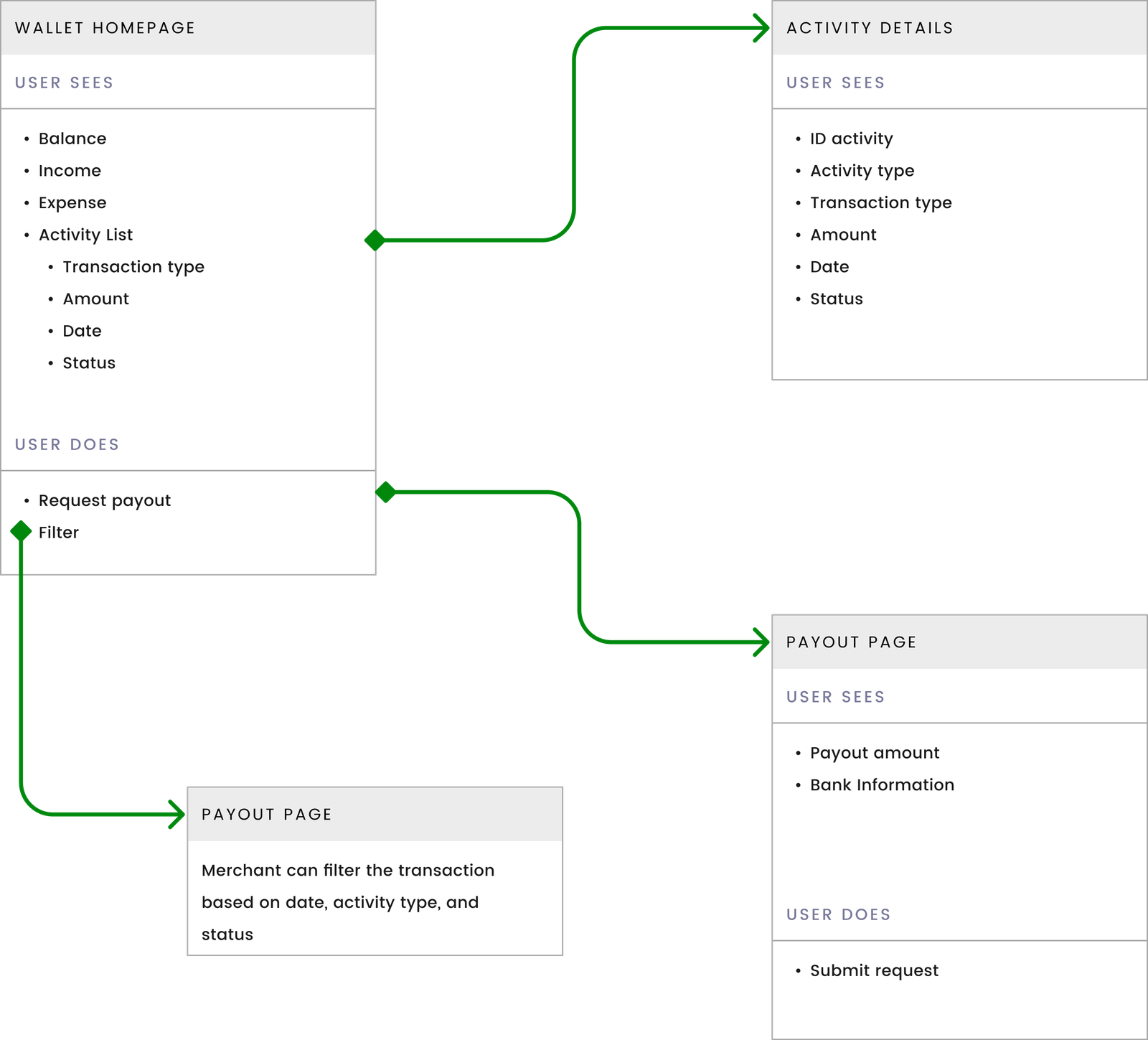

Information Architecture

I began by creating the information architecture to help me and the team structure the information on the wallet feature screens.

Design Exploration

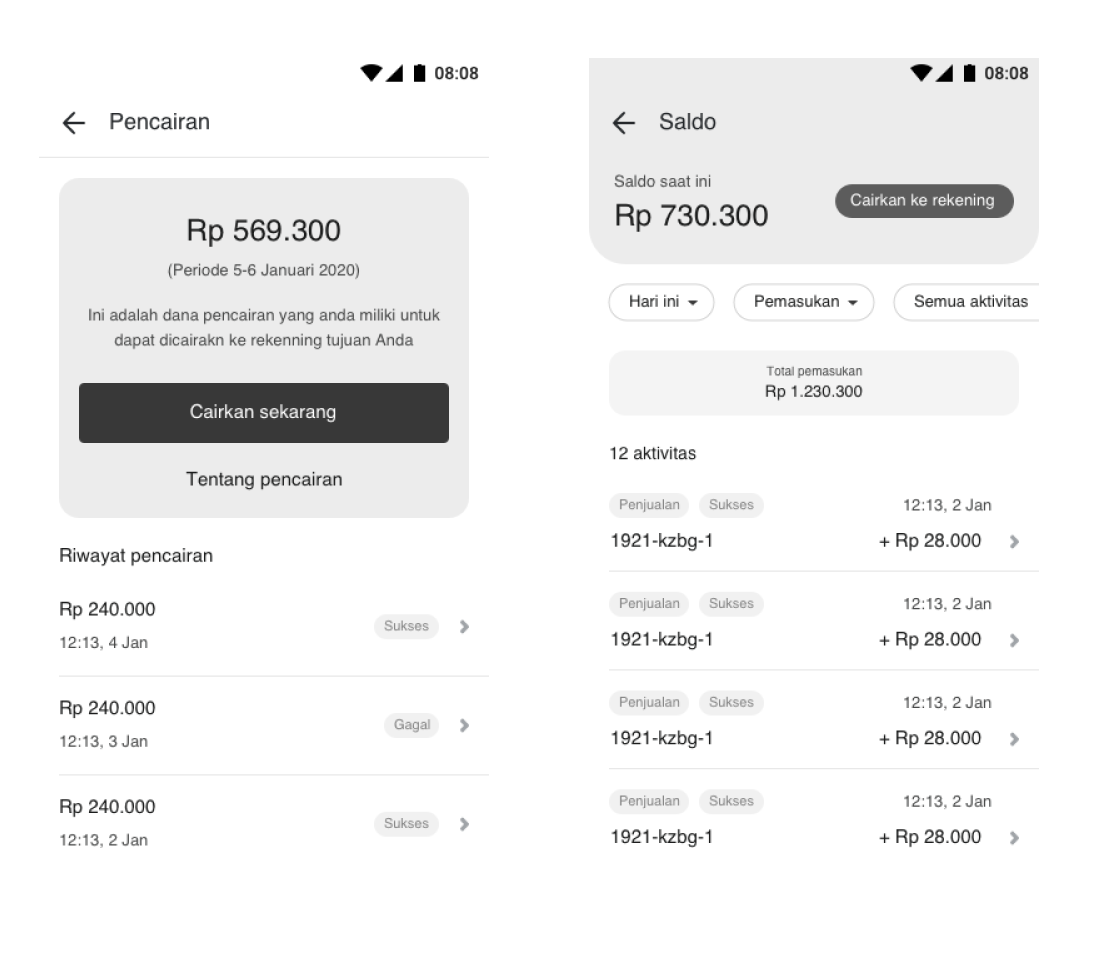

Wireframe First Iteration

I began creating a few low-fidelity wireframes to facilitate discussions with the Product Manager, Engineers, Researchers, and Business Stakeholders.

Design Exploration

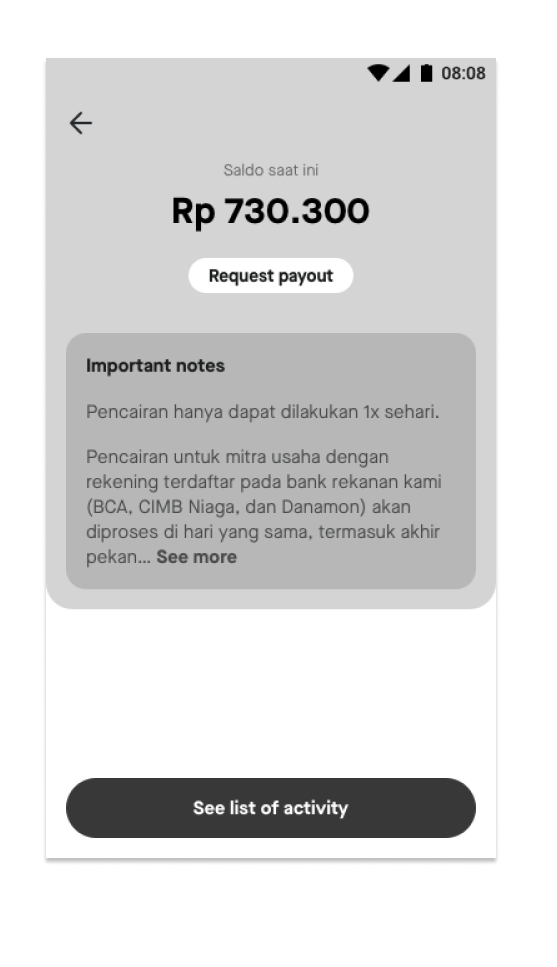

Wireframe Second Iteration

After discussing the first iteration with the wallet team stakeholders and conducting a design review with the merchant design team, we received several feedback items regarding the wallet feature’s homepage and other screens.

Once I completed updating all the wireframes, we began converting them into high-fidelity designs, and we are now ready to conduct usability tests.

Design Exploration

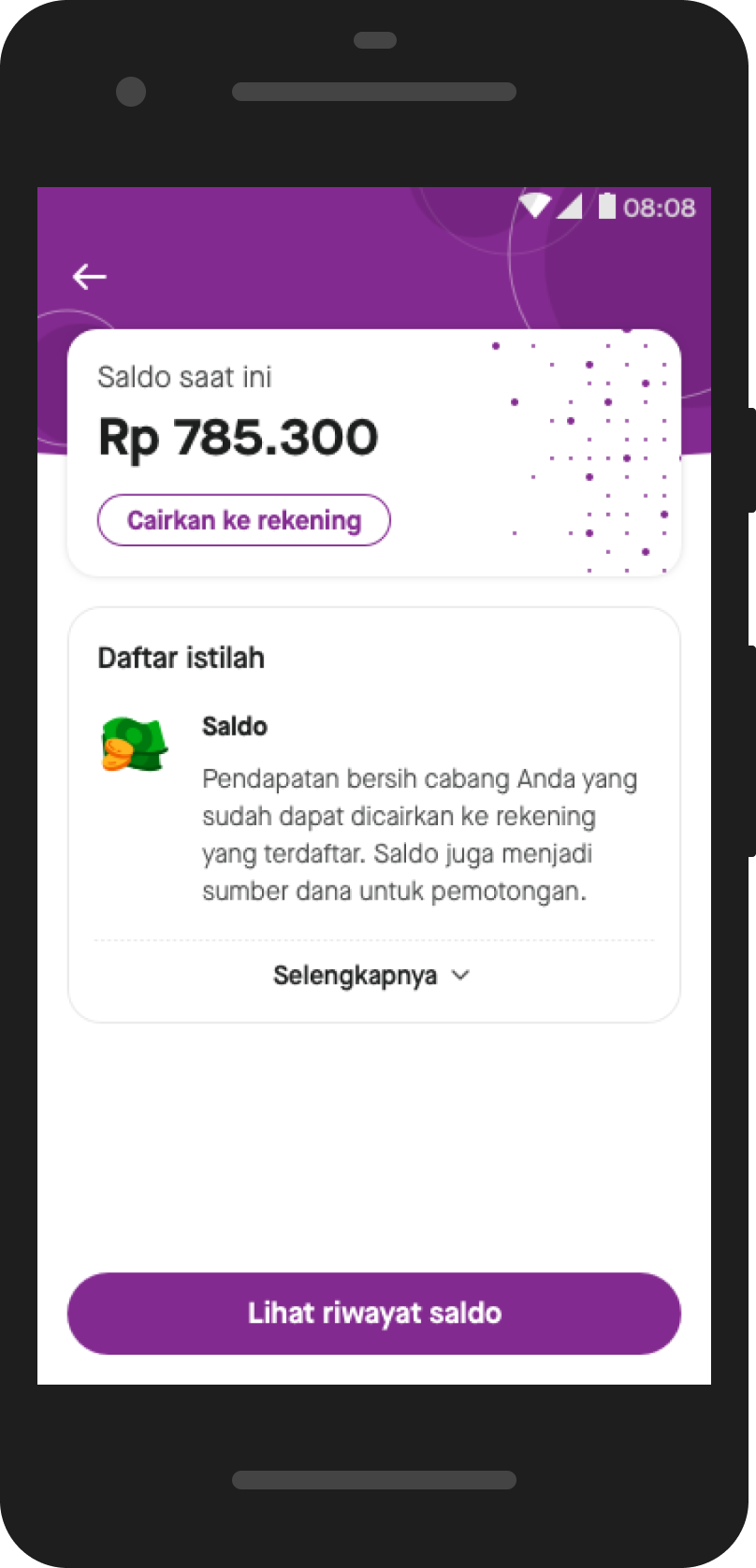

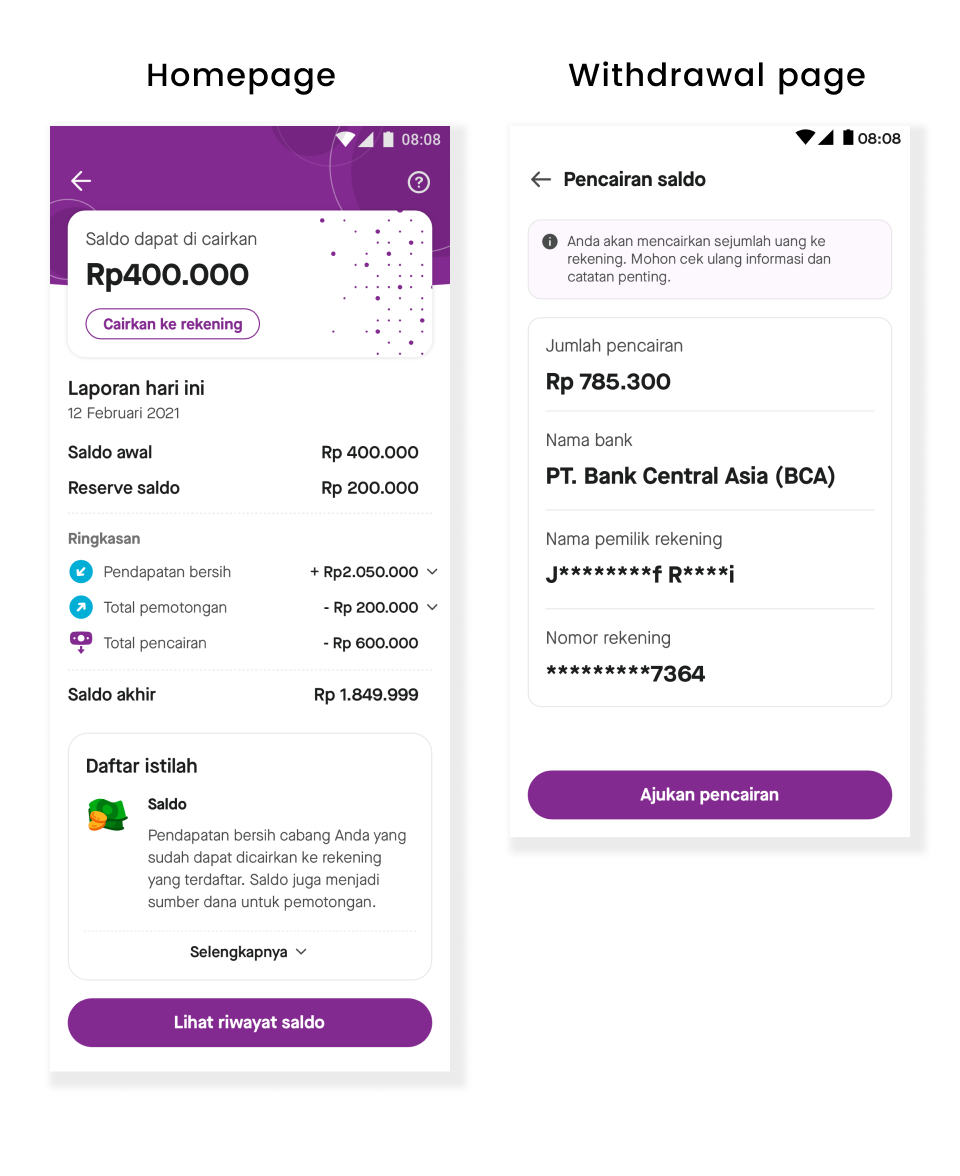

Hi-Fidelity Mockups

Once we finished creating all the high-fidelity mockups, incorporating copywriting provided by the UX writer, and developing the prototype, we were ready to test it.

Design Exploration

Usability Testing key result

We used Maze to conduct remote usability testing during the first year of the COVID-19 pandemic. We successfully interviewed eight merchants, and we obtained valuable feedback and insights. We categorize these insights into three categories.

Solution Adjustment

Introducing On-Demand Payout, to enable merchants to accumulate their balance for a maximum of 7 days

During the UT, we found out that many merchants are happy with the new system because they can save money and separate their own money from their business money (this feedback came from medium and big merchants with budget allocations). However, they also expect a system that can transfer the money to their bank account after a certain period of time.

On the other hand, we also noticed that small merchants rely on daily income to sustain their business. After a long discussion, especially when we tried to convince the business stakeholders that we need to set a maximum number of days that Gojek can hold merchant money before the system automatically sends it. Finally, we all agreed to have a 7-day threshold.

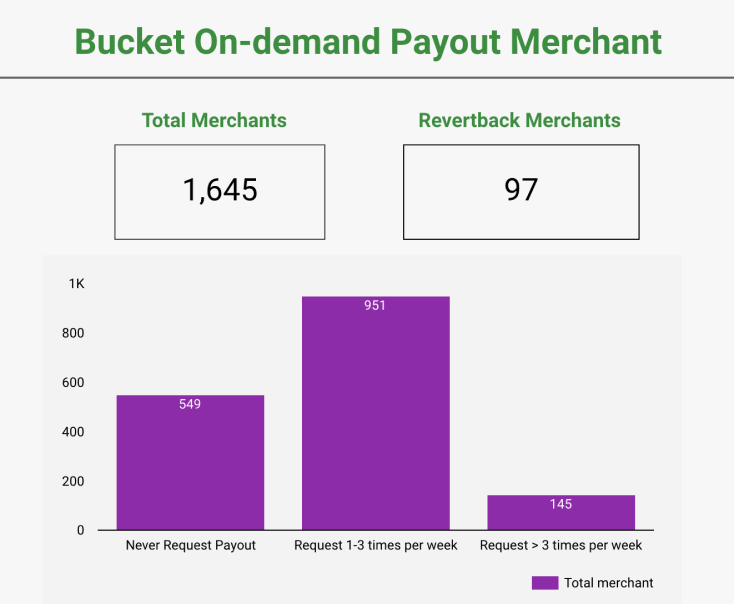

Pilot Rollout Metrics

- Merchant’s request of revert back from on-demand withdrawal to daily payout under 5% of the total adoption

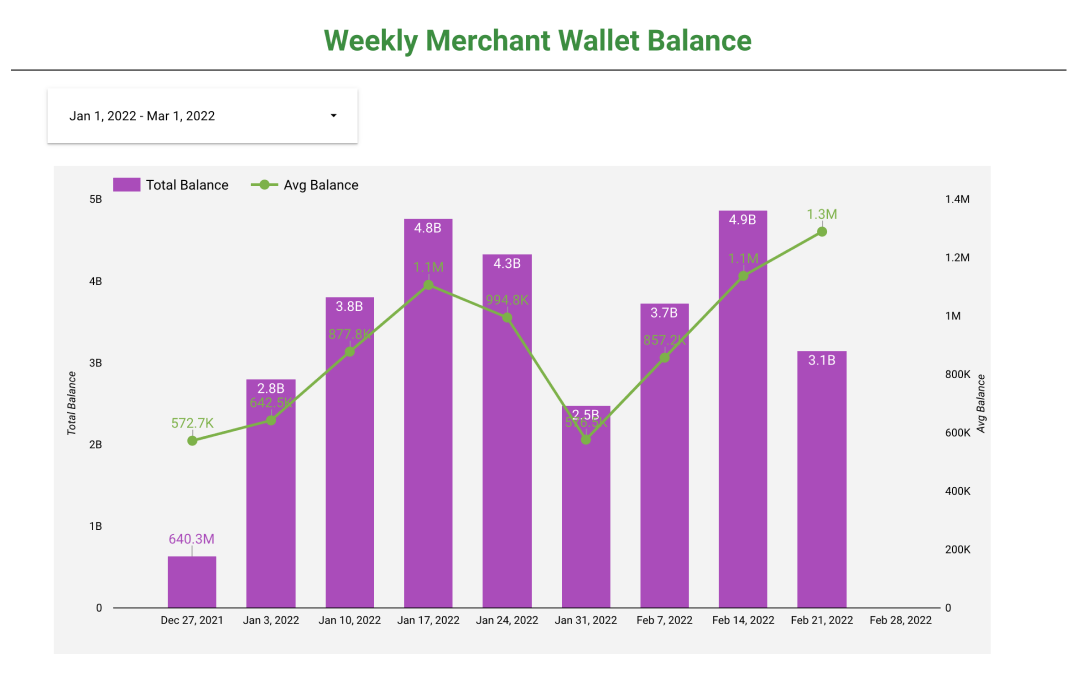

- Increase merchants’ average balance

- Reduce number of complaints related to wallet and payout

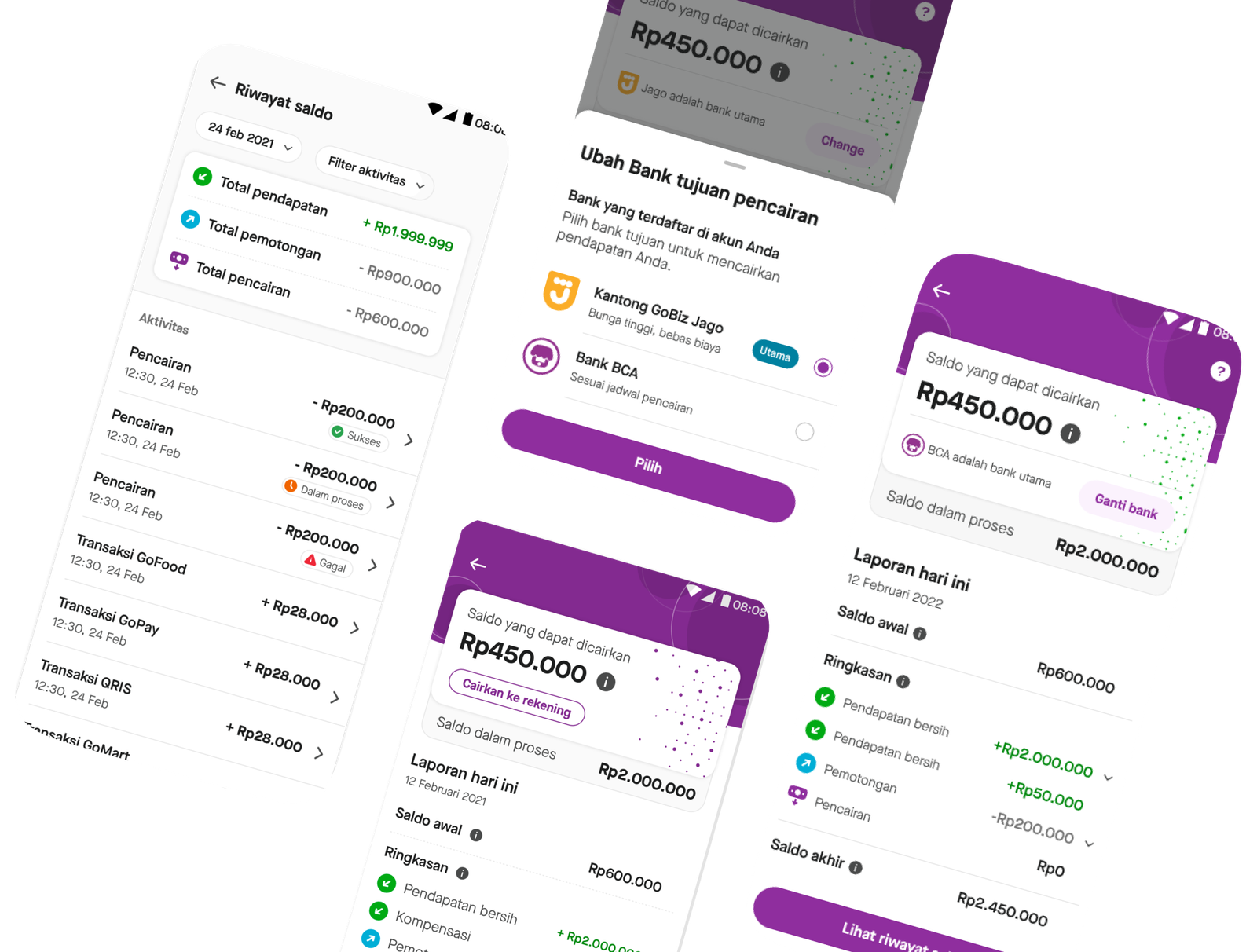

Design Iteration

Enhancement to the wallet homepage

With this enhancement, we aim to address some of the negative perceptions that arose from the previous usability testing.

Objective on this enhancement

- Providing concrete information to help merchants do a proper reconciliation on daily basis

- To enhance understandability of the merchants toward their current balance

Design Iteration

Approach 1

Rationale

- By adding a daily summary to the wallet homepage, we hope to make it easier for merchants to quickly review their current balance.

- We will add a compensation field to the summary to make merchants aware of any applicable deductions.

- As the balance in a merchant’s account is a combination of settled and unsettled funds, we will provide clear information on the withdrawal page to manage their expectations.

Questions

Should we separate the effective and pending balance directly in the homepage?

Design Iteration

Approach 2

Rationale

- Keeping the same design as the previous approach, and add reserve balance to the page

- Contain all the information and make it transparent to the merchants, yet its hard to understand and too much numbers in it

- This reserve balance will bring more question to the merchants

Questions

Should we really add reserve balance to this page?

Final Design

The final design after enhancement process

After numerous design critiques, discussions, and user tests, we have decided to move forward with this final design for the pilot release.

The Result

The business impact that we generate since the feature are rollout to the pilot merchants

5,89%

97 out of 1645 merchants are revertback from manual to auto payout since the pilot rollout

6 times

Increasing the average merchants’ balance on wallet, from IDR 86.000 – 239.000 to IDR 572.700 – 1.300.000

What we learn

Always give users option

Providing users with options in every solution is critical for improving user experience, increasing engagement and satisfaction, and making a solution more accessible and inclusive to a broader range of users.

Communicating with stakeholders is critical to sharpening solutions

Communicating with stakeholders is critical to sharpening solutions as it clarifies requirements, provides user feedback, enables a collaborative approach, helps avoid assumptions, and keeps everyone informed. By working together with stakeholders, Product Designers can create solutions that meet the needs of users and stakeholders, leading to a more successful outcome.